Public Adjusters In Orlando Florida

We Work For You, Not The Insurance Company!

We ensure your claim is handled professionally and timely so that you receive the settlement you are entitled to.

No Recovery No Fee!

Public Adjusters In Orlando, FL

Professional Team

Our team has many years of experience in public adjusting. we know the ins and outs of the insurance companies so you can maximize your claim!

Support

Whatever the time or day, we are available to give you an inspection of your claim.

Proven Results

We ensure that the insurance companies do not ake advantage of you. We have training to handle mediation and appraisals to help you get a fair settlement.

We Work For You, Not The Insurance Company!

OUR PROCESS

Free Inspection and Policy Review.

If there is damage to your home or business, we provide full inspection and evaluation of all the damages and your policy at no cost. As Public Adjusters, we know what you are covered for.

We Handle Every Step of Your Insurance Claim Process

While your insurance company will send an adjuster that represents them, we will represent you!

Get paid the full amount you deserve for your claim.

Get the maximum insurance payout!

Why Choose Us?

The Perfect Solution For All Your Insurance Claims.

All Service Adjusting is dedicated to public service, which includes educating clients about wind and hurricane losses, flood damage, fire and smoke damage, and more. Our goal is to provide our clients with the highest level of insurance adjusting. As we negotiate with the insurance company, we keep our clients top of mind.

No Recovery No Fee!

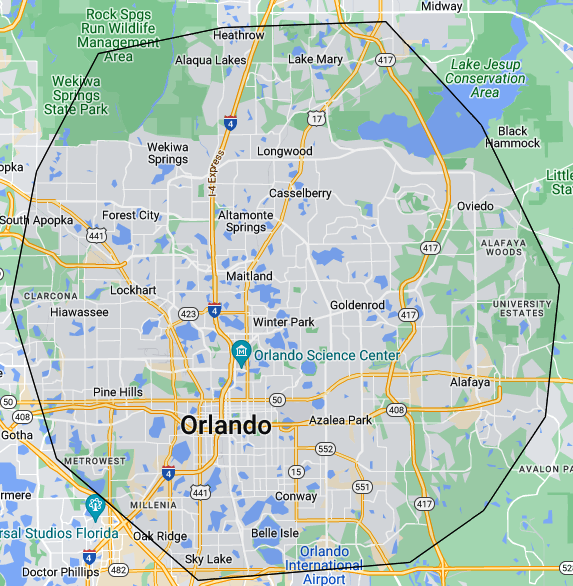

We Proudly Serve Orlando Florida

Orlando

Heathrow

Alaqua lakes

Lake Mary

Wekiwa Springs

Longwood

South Apopka

Forest City

Altamonte Springs

Casselberry

Oviedo

Maitland

Lockhart

Hiawassee

Winter Park

Goldenrod

Pine Hills

Azalea Park

Metrowest

Millenia

Conway

Belle Isle

Sky Lake

Oak Ridge

Get The Settlement You Are Entitled To!

Fill out the form, or call us to set up a meeting at

407-326-2968

Request Your FREE Claim Analysis

Request Your FREE Claim Analysis

No Recovery No Fee!

FAQ's

Will my settlement be higher if I hire a public adjuster?

Yes, in most cases, hiring a public adjuster will lead to a higher settlement. This is because your claim will be presented more thoroughly and in alignment with your policy’s coverage. A well-documented, detailed claim often results in a higher payout. We meticulously review evidence, inspect the damage, and document everything accurately to ensure you get the compensation you deserve. Studies show that claims filed without the help of a public adjuster are often incomplete.

Define the term, public adjuster

A public adjuster is a licensed professional who advocates for the policyholder during the insurance claim process. Unlike insurance company adjusters, a public adjuster represents your best interests by negotiating and appraising your claim.

Can my insurance company cancel my policy if I hire a public adjuster?

No, it is illegal for an insurance company to cancel or discriminate against you for hiring a public adjuster. Florida law protects your right to hire one.

Once a claim has been closed, is it too late to hire a public adjuster

Usually, it’s not too late. Florida law allows for supplemental claims to be filed for several years after the date of loss. If you feel you were underpaid, we can review your claim and help you pursue additional compensation.

What is the difference between a public adjuster and an insurance company adjuster?

An insurance company adjuster works for the insurance company and aims to protect their employer’s interests. A public adjuster, on the other hand, works exclusively for you—the policyholder—to ensure you receive the maximum settlement possible based on your coverage and the damage.

Are public adjusters regulated?

Public adjusters are licensed and regulated by the Florida Department of Financial Services, ensuring they work solely for the benefit of the policyholder.

Who hires the services of a public adjuster?

Public adjusters are hired by individuals, businesses, attorneys, banks, and even other insurance professionals who want expert representation for their own claims. Once clients experience the benefits of a public adjuster, they rarely handle claims on their own again.

When should I contact a Public Adjusting Service?

You should contact us immediately after experiencing a loss. Getting us involved early allows us to manage the claim process from the beginning, ensuring the best possible outcome.

How do public adjusters prepare claims?

Public adjusters work with experts like appraisers, engineers, and accountants to gather evidence and document the loss thoroughly. This comprehensive approach ensures you receive the maximum settlement possible.

Are there minimum value requirements for submitting a claim?

No claim is too big or too small for us. If you believe you need help with your claim, contact us, and we’ll provide our professional opinion.

On average, how much does it cost to hire a public adjuster?

Public adjusters typically charge a small percentage of the amount recovered from the insurance company. These fees are regulated by the Florida Department of Financial Services.

If my claim gets denied, am I entitled to a second opinion?

Absolutely! We frequently work with clients whose claims were initially denied. We can reopen the claim, negotiate with your insurance company, and help secure compensation for valid damages.

What Information Do I Need When Filing a Claim?

When filing a claim, having the right information on hand will help streamline the process. Here's what you'll need:

- Policyholder Information: The insured's name, address, phone number, email, and policy number.

- Description of Loss: Time, date, and location of the incident, along with a detailed account of the damages.

- Authority Notification: Record any authorities contacted, such as the fire department or police.

- Emergency Services & Damage Mitigation: Let us know if you've reached out to any emergency service companies or taken any steps to mitigate the damage.

If you're unsure whether you need a public adjuster, feel free to give us a call or fill out our contact form below. We're here to help!

Examples of property damage claims

No Recovery No Fee!