NEED CLAIMS HELP?

DENIED OR CLOSED CLAIMS? WE CAN REOPEN

Roof Leak Claims

We Service Orlando FL

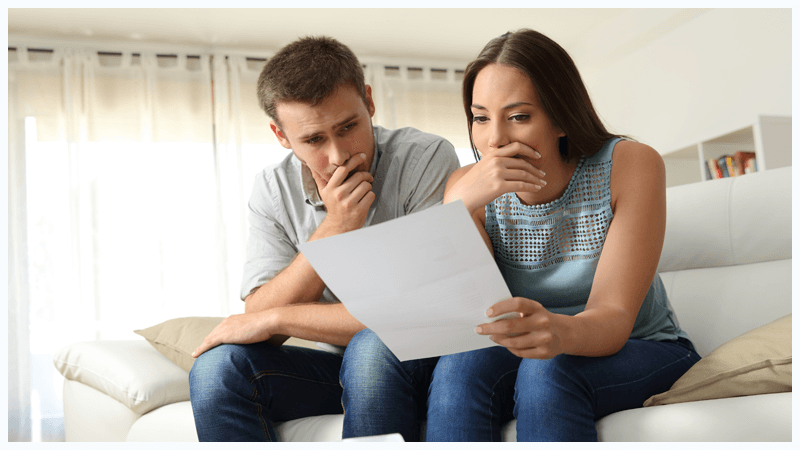

Property insurance can be difficult to understand. Filing a claim can be frustrating, time-consuming,

and overwhelming. We make filing a claim stress-free.

The Perfect Solution For All Your Insurance Claims.

All Service Adjusting is dedicated to public service, which includes educating clients about wind and hurricane losses, flood damage, fire and smoke damage, and more. Our goal is to provide our clients with the highest level of insurance adjusting. As we negotiate with the insurance company, we keep our clients top of mind.

Our expert public insurance adjusters are committed to ensuring you receive the compensation you deserve after experiencing flood damage. Here's why you should choose us:

- Free claim analysis

- No fee unless we recover your claim

- All claims handled in-house – no referrals

- Experienced, hand-picked professionals on our team

We’ve been helping Florida residents navigate flood damage insurance claims for years. Our efficient, skilled team is supported by a diverse group of professionals, including:

- Attorneys

- Former insurance company adjusters

- Consultants

- Public adjusters

- Real estate experts

Let us help you resolve your claim today!

No Recovery No Fee!

407-326-2968

Roof Damage Leak Claims Orlando, FL

Florida's unpredictable weather, coupled with factors like aging, neglect, dislocated tiles, and seasonal storms, often leaves roofs vulnerable to damage. Whether it’s minor water seepage or a major breach requiring a complete roof replacement, taking early action is key. Don't let the hassle of addressing a small leak stop you from preventing more severe problems down the road.

Insurance companies may attempt to minimize the extent of repairs, undervalue the cost of fixing leaks, or even deny claims by attributing damage to normal wear and tear or deterioration. Our team is here to help you accurately assess the damage and secure the fair compensation you deserve.

We’ll thoroughly review your insurance policy to ensure you receive any additional compensation for interior or structural damage, as well as coverage for living expenses if temporary relocation is necessary during repairs. Our goal is to resolve roofing issues before they escalate, protecting your property from further damage. Rest assured, we’ll work to restore your roof quickly and efficiently, giving you peace of mind under a safe and reliable structure.

Roof Damage Insurance Deductibles and Property Insurance Deductibles

Roof damage insurance deductibles and property insurance deductibles are distinct components of your insurance policy, each serving different functions:

Property Insurance Deductible:

- Definition: This is the initial out-of-pocket cost a policyholder must pay before the insurance company covers any claims.

- Coverage: The property insurance deductible applies to the overall policy and isn’t specific to a particular type of damage or peril.

- Standard Policy Feature: It is a common feature in most property insurance policies, including homeowners’ and commercial property insurance.

- Application: This deductible applies to various claims, such as theft, fire, vandalism, and roof damage.

- Customization: Policyholders can often choose their deductible amount when purchasing or renewing their policy. Opting for a higher deductible typically lowers insurance premiums, while a lower deductible increases premiums.

Understanding these differences is crucial when navigating claims and determining your financial responsibility in the event of roof or property damage.

Understanding Roof Damage Insurance Deductibles

Roof damage insurance deductibles are a specific subset of property insurance deductibles that apply exclusively to damage sustained by your roof. Here’s what you need to know:

- Scope: These deductibles come into play when a claim is filed for roof-related damage, such as that caused by hail, wind, storms, or other covered events.

- Structure: Roof damage deductibles can be either a fixed amount or a percentage of your property’s insured value, as determined by the insurance company.

- Variation: The deductible for roof damage may differ from those for other types of property damage within the same policy.

- Separate Provisions: Due to the unique and often high costs of roof repairs or replacements, some insurance policies have separate deductible provisions specifically for roof damage.

Understanding these specifics can help you navigate your policy more effectively when dealing with roof damage claims.

Denied Insurance Claims

Denied & Underpaid Insurance Claims

If you sustain property damage and feel your claim has been wrongly denied or underpaid and you believe your damage is covered, All Service Adjusting will review your entire policy. If we feel there is reason the insurance company was wrong for denying your claim, we can go over all of the options available to you at that time. Denied claims doesn't mean there are no options.

Going over your claim to make sure you have reached a fair settlement from your insurance company is the service we provide. It is common for most claims to be underpaid or over looked, so hiring a licensed public adjuster can give you a professional second opinion on your insurance claim. Licensed public adjusters can help reverse denied insurance claims or get you a better settlement.

Why hire an experienced public adjuster for your property damage claim?

Property damages can present several unknown issues to homeowners. In the Public Adjusters eyes, it's common that most homeowners are not prepared to deal with the immediate aftermath of a disaster.

Property damage issues such as blown roof shingles, exposed roof sheathing, fallen trees, food spoilage from power outages, water intrusion to the interior of a home causing microbial growth such as mold become imperative and need to be addressed immediately.

This is why hiring an experienced public adjuster has advantages like properly addressing and identifying underlying issues that you or insurance company may not understand. Once the claims on certain repairs are made to the property, many of these issues will be difficult to investigate, document and repair. These types of issues typically relate to such things as structure and non-cosmetic damages and will most likely remain unfixed until properly remedied. Hiring a Public Adjuster is always encouraged at the earliest stages of your claim. All Service Adjusting will assist the owners of residential properties on underpaid claims, new claims, and even denied claims coverage under your homeowners policy.

Meet the All Service Team!

No Recovery No Fee!

407-326-2968

Get The Settlement You Are Entitled To!

Fill out the form, or call us to set up a meeting at

407-326-2968

Request Your FREE Claim Analysis

Request Your FREE Claim Analysis

We will get back to you as soon as possible.

Please try again later.

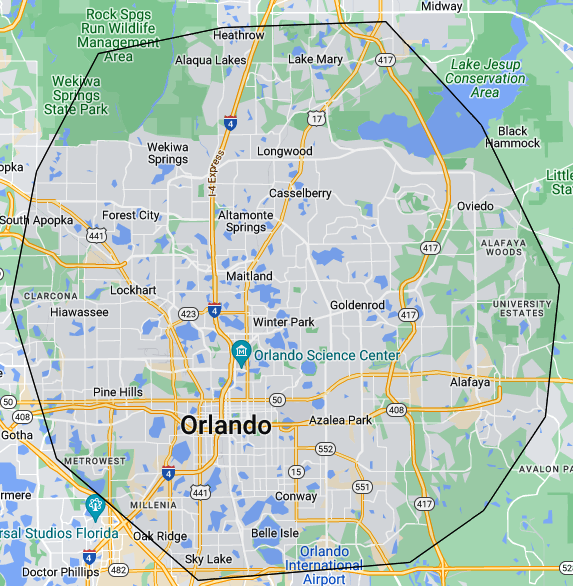

We Proudly Serve Orlando Florida

Orlando

Heathrow

Alaqua lakes

Lake Mary

Wekiwa Springs

Longwood

South Apopka

Forest City

Altamonte Springs

Casselberry

Oviedo

Maitland

Lockhart

Hiawassee

Winter Park

Goldenrod

Pine Hills

Azalea Park

Metrowest

Millenia

Conway

Belle Isle

Sky Lake

Oak Ridge

No Recovery No Fee!

407-326-2968