NEED CLAIMS HELP?

DENIED OR CLOSED CLAIMS? WE CAN REOPEN

Mold Damage Claims

We Service Orlando FL

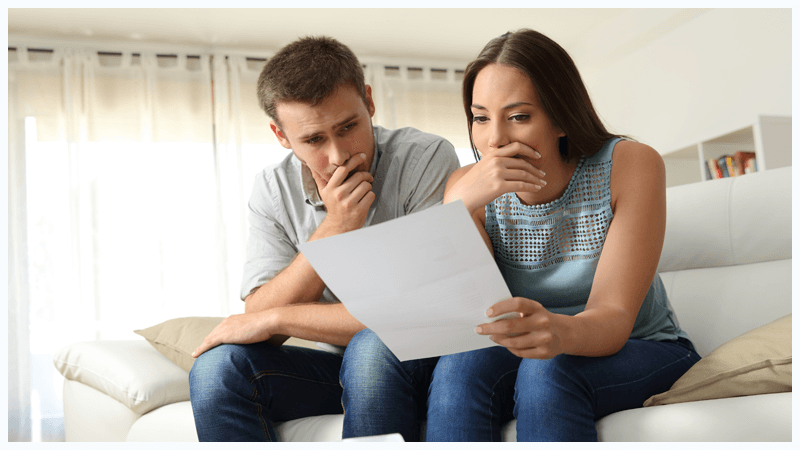

Property insurance can be difficult to understand. Filing a claim can be frustrating, time-consuming,

and overwhelming. We make filing a claim stress-free.

The Perfect Solution For All Your Insurance Claims.

All Service Adjusting is dedicated to public service, which includes educating clients about wind and hurricane losses, flood damage, fire and smoke damage, and more. Our goal is to provide our clients with the highest level of insurance adjusting. As we negotiate with the insurance company, we keep our clients top of mind.

No Recovery No Fee!

407-326-2968

Our expert public insurance adjusters are committed to ensuring you receive the compensation you deserve after experiencing flood damage. Here's why you should choose us:

- Free claim analysis

- No fee unless we recover your claim

- All claims handled in-house – no referrals

- Experienced, hand-picked professionals on our team

We’ve been helping Florida residents navigate flood damage insurance claims for years. Our efficient, skilled team is supported by a diverse group of professionals, including:

- Attorneys

- Former insurance company adjusters

- Consultants

- Public adjusters

- Real estate experts

Let us help you resolve your claim today!

Mold Damage Claims Orlando, FL

Mold is a common issue in Florida homes, where moisture levels are high. Moist environments create the perfect conditions for mold to thrive, which can damage property and negatively impact residents' health, particularly their respiratory systems. Given the potential for property damage and health risks, combined with the limitations many insurance policies place on mold coverage, it’s often most effective to link mold damage to water damage when filing a claim. We can assist you in preparing a comprehensive mold damage insurance claim.

What is a Mold Insurance Claim??

Mold is a resilient fungus that can infiltrate homes or commercial properties, often growing in unexpected places. It can even be invisible to the naked eye and spread rapidly in the presence of moisture.

While mold coverage is often limited in insurance policies, water damage usually has fewer restrictions. Since mold growth typically results from water damage, it is common to file a water damage claim with mold as a secondary issue caused by the water. This strategy can increase your chances of securing coverage for mold remediation and related repairs.

Mold Damage Insurance Claims: Understanding the Changes and Your Options

In the past, most property insurance policies covered mold damage if it resulted from a covered peril, such as a sudden plumbing leak, fire control, storm, or another event listed in your insurance policy. However, as public awareness about the health risks associated with mold has grown, insurance companies have made significant changes to their policies. Cleanup, removal, and remediation processes for mold have become both expensive and hazardous, leading insurers to exclude mold coverage, even when it stems from a covered peril. Some insurers now offer limited mold coverage for an additional premium.

Mold contamination is a serious issue, potentially causing illness and significant property damage. In earlier times, insurers downplayed mold damage, often recommending bleach as a solution. Now, insurance companies frequently cite mold exclusions, even in cases where coverage may apply. We can help assess your mold damage claim and guide you on the appropriate next steps.

Mold damage often requires professional testing to determine the specific remediation protocol for the type of mold present. A remediation contractor will follow this protocol to remove the mold, and air clearance testing is needed afterward to ensure the remediation was successful.

We will carefully investigate your mold damage and advise you on the best way to document and assess your claim. If external experts are necessary, we’ll guide you through that process as well. If you need assistance with your mold insurance claim or want to explore your options, feel free to contact us for help.

Denied Insurance Claims

Denied & Underpaid Insurance Claims

If you sustain property damage and feel your claim has been wrongly denied or underpaid and you believe your damage is covered, All Service Adjusting will review your entire policy. If we feel there is reason the insurance company was wrong for denying your claim, we can go over all of the options available to you at that time. Denied claims doesn't mean there are no options.

Going over your claim to make sure you have reached a fair settlement from your insurance company is the service we provide. It is common for most claims to be underpaid or over looked, so hiring a licensed public adjuster can give you a professional second opinion on your insurance claim. Licensed public adjusters can help reverse denied insurance claims or get you a better settlement.

Why hire an experienced public adjuster for your property damage claim?

Property damages can present several unknown issues to homeowners. In the Public Adjusters eyes, it's common that most homeowners are not prepared to deal with the immediate aftermath of a disaster.

Property damage issues such as blown roof shingles, exposed roof sheathing, fallen trees, food spoilage from power outages, water intrusion to the interior of a home causing microbial growth such as mold become imperative and need to be addressed immediately.

This is why hiring an experienced public adjuster has advantages like properly addressing and identifying underlying issues that you or insurance company may not understand. Once the claims on certain repairs are made to the property, many of these issues will be difficult to investigate, document and repair. These types of issues typically relate to such things as structure and non-cosmetic damages and will most likely remain unfixed until properly remedied. Hiring a Public Adjuster is always encouraged at the earliest stages of your claim. All Service Adjusting will assist the owners of residential properties on underpaid claims, new claims, and even denied claims coverage under your homeowners policy.

No Recovery No Fee!

407-326-2968

Get The Settlement You Are Entitled To!

Fill out the form, or call us to set up a meeting at

407-326-2968

Request Your FREE Claim Analysis

Request Your FREE Claim Analysis

We will get back to you as soon as possible.

Please try again later.

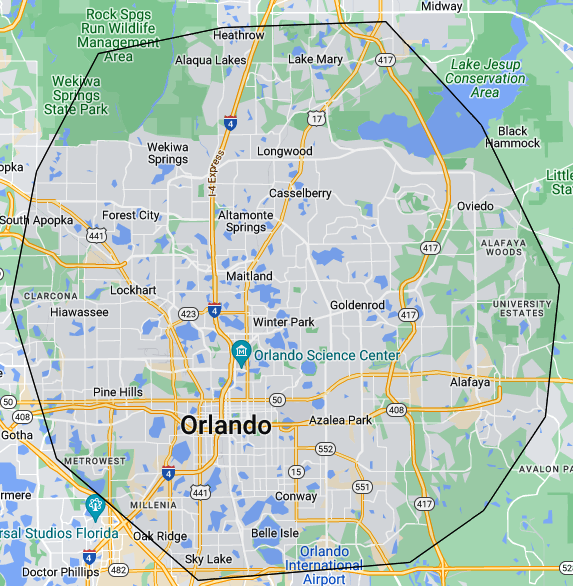

We Proudly Serve Orlando Florida

Orlando

Heathrow

Alaqua lakes

Lake Mary

Wekiwa Springs

Longwood

South Apopka

Forest City

Altamonte Springs

Casselberry

Oviedo

Maitland

Lockhart

Hiawassee

Winter Park

Goldenrod

Pine Hills

Azalea Park

Metrowest

Millenia

Conway

Belle Isle

Sky Lake

Oak Ridge

Meet the All Service Team!

No Recovery No Fee!

407-326-2968